Why would 76-year-old Larry Cook transfer over $3.6 million out of the country just before his death?

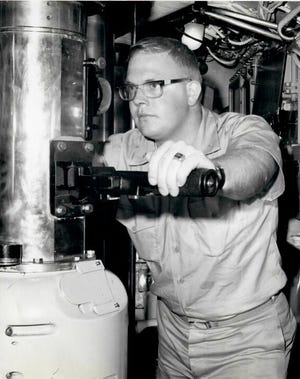

That was tickling the mind of Janine Satterfield as she was mourning her beloved uncle. A decorated veteran who served with the U.S. Navy as Commander for 24 years until 1992, he lived alone and had no children or spouse.

Satterfield discovered this mystery when she needed to find his Social Security number to bury her uncle. A nearby neighbor she asked to go into his home in Virginia for his documents instead sent photos of international wire transfers he made in amounts as large as $49,500, going mostly to Thailand.

Through her uncle’s meticulous records, Satterfield discovered her uncle had become a victim of a scam that started in October 2020 and continued until March 2021.

He died a month later.

After his death, his niece's looming thought: Why did the banks allow all of these large transfers to go through?

The lawsuit against Wells Fargo and Navy Federal Credit Union

Satterfield is now suing Wells Fargo and the Navy Federal Credit Union claiming that the institutions failed to protect her uncle from being swindled out of $3.6 million.

Cook made 75 international transfers to possible scammers abroad, and most of the wires amounted to $49,500 each, according to the complaint filed in Virginia. In total, he used Wells Fargo once to send $49,500 and the Navy Federal Credit Union 74 times to send a total of $3,631,200. According to the wire records, Cook wrote that the purpose of the transfer was for a “loan repayment.”

According to the complaint, Cook’s credit union reported him to adult protective services mid-December but still allowed 42 more international wires to process.

Satterfield alleges in the complaint that both institutions acted in bad faith by failing to investigate the suspicious wires and is suing both banks for the money Cook lost in the scam – Wells Fargo for $49,500 and Navy Federal Credit Union for $3,633,050, which includes $1,850 worth of wire fees.

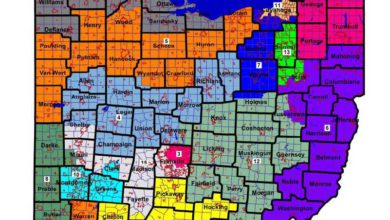

‘Beating the bad guys’:How one vigilante aunt in Ohio took down an identity theft scheme

She also alleges that Cook’s credit union was negligent for not stopping the numerous wires and “undertook the duty” to protect him following the voluntary report they made to Fairfax County Adult Protective Services and should have taken internal steps to stop the wires. The credit union continued processing the wires even after APS confirmed with them on Jan. 28, 2021, that Cook needed services and was at risk of being abused, neglected and exploited.

While APS didn’t stop the wires, they asked the credit union to continue to monitor his accounts.

Cook had suffered a stroke in 2019, according to the complaint, and when he was discharged from rehabilitation, the staff there noted that Cook had “poor insight into his condition, lacked insight into his deficits,” and was concerned about going back to work as a consultant for the Navy and being cleared to drive. He had no family support.

While representatives for both Wells Fargo and the Navy Federal Credit Union did not comment due to pending litigation, both provided USA TODAY prepared statements.

“Our members are always our first priority and we handle all member transactions with great care,” a Navy Federal Credit Union spokesperson said.

“Wells Fargo takes financial exploitation very seriously. We are committed to helping our customers avoid fraud and scams through various resources, including ongoing education efforts,” a Wells Fargo spokesperson said.

According to The Financial Crimes Enforcement Network, a division of the U.S. Treasury Department, elder financial exploitation is the most common form of elder abuse, but remains widely unreported. According to the Consumer Financial Protection Bureau, in 2020, financial institutions filed more than 62,000 reports involving elder financial exploitation worth $3.4 billion.

The scam

It started with a phishing email.

On Oct. 5, 2020, Cook got an email that said his iPad and PlayStation from Amazon were on the way, and if he had questions, he should call “Order Help-Desk.”

The sender’s email address didn’t appear to be associated with Amazon, but records show Cook contacted the sender and had received a cancellation form, which gave vague instructions for a refund that involved his bank.

The next day, he wired $49,500 to someone in Singapore through his Wells Fargo account.

Wire records show that he sent money to different people, at different addresses for the purpose of a “loan repayment.” The complaint doesn’t offer additional details about the scammers.

Luckily, Cook wasn’t the type of person to throw away anything. He knew how to keep records – letters, invitations, tax records, bills and payments.

What happened next:Alleged scammer in USA TODAY profile rearrested in Houston

Satterfield gets emotional when she talks about finding items that held sentimental value to her uncle- his Christmas stocking, a Boy Scouts cap, buttons from his uniforms, and ribbons from state fairs.

“He threw away nothing, it all mattered to him,” Satterfield said.

That very habit of record-keeping would lead Cook’s family to the folders that held documents for the international wires.

In November 2020, Cook tried a second time to wire money through Wells Fargo but was denied. According to the complaint, Wells Fargo didn’t give a reason. But Cook instead wired the money from his Wells Fargo account into his credit union account and sent the money abroad.

What to know about identity theft:How can I find out if someone is using my identity?

On Dec. 15, 2020, a credit union representative reported Cook to Fairfax County Adult Protective Services, saying the transfers were “indicative of possible elder financial exploitation.”

The representative reported that Cook had been warned about being a victim of a scam but still wanted to proceed with the transactions and appeared to be “mentally competent.”

According to Satterfield’s complaint, Cook was a conservative spender, so sending exorbitant amounts of money to foreign banks was out of the ordinary for him.

“The act itself shows he wasn’t competent,” said Paula Williamson, Satterfield’s sister.

They still don’t know who the scammers are, but bringing those people to justice is important, too, Kimberly Ann Murphy, Satterfield’s lawyer, said.

What is a bank's responsibility?

Naomi Cahn, professor at University of Virginia School of Law and expert in family law, estates, trusts and aging, said prior to the move to online banking, people went into banks often, which helped them develop a relationship with their bank, and in turn, it gave banks an opportunity to observe changes in their customers.

But with Cook being elderly, should the bank have done more to protect him?

“Do you want to make assumptions about everybody over a certain age? Should bank tellers be assessing competence every time a customer comes in?” Cahn asked.

While it’s unknown what type of relationship Cook had with each of his banks, he’d been a customer at both since the 1970s, according to the complaint.

And while some states, like California, have mandatory reporting when they expect elder financial abuse, Virginia has voluntary reporting, Cahn said.

“We all expect secrecy with our bank accounts, and it’s protected,” she said. “But this is an exception to secrecy with respect to bank accounts.”

In 2018, Congress passed the Senior Safe Act, which provided financial institutions and employees who reported elder financial exploitation with immunity from liability in any civil or administrative proceeding. To qualify for immunity, a report should have been made to a qualified agency like law enforcement, local adult protective services, state financial regulatory agency, or U.S. Securities and Exchange Commission. And only financial institutions that were either credit unions, depository institutions, investment advisers, broker dealers, transfer agents, or insurance companies, qualified for the immunity. In addition, only employees who were trained on how to identify and report elder financial exploitation qualified for immunity.

In 2022, Virginia also strengthened reporting laws, more than a year after Cook’s death. The new rules allow financial institution staff to delay, refuse to disburse and execute funds if they suspect exploitation.

While Cook’s credit union filed the APS report, and APS officials communicated with the credit union, Cahn said the question remains on what happens after and whether the bank or social service should have stopped the 42 international wires that continued until March 2021.

Murphy, Satterfield’s lawyer, said it’s a question they’ve been pondering, too.

“What is a financial institution supposed to do? How are they protecting their customers, how are they protecting themselves, and where is that money actually going?” Murphy asked.

When USA TODAY asked, both Wells Fargo and Navy Federal Credit Union would not offer further comment on their internal process about elder fraud exploitation.

Murphy said scams come at a high cost to an elderly person – especially one who is incapacitated – who end up losing their life savings.

Satterfield said this scam her uncle fell for was “beyond human judgment" and that legislative changes, need to be in place before another elderly victim is scammed out of their money.

"We're literally all one click away," Satterfield said.

Watching out for elder financial exploitation

Experiencing an elderly loved one mentally declining can be hard for family members and caregivers to watch, so it's important to prepare ahead of time to prevent elder financial exploitation by having a conversation about their finances sooner than later.

The Consumer Financial Protection Bureau also has advice and tips on how people can prepare ahead of time should they experience a decline in their capacity to manage their money:

- Organize important documents. Organize information for bank and brokerage statements, mortgage and credit information, insurance policies, pension or benefit summaries, Social Security payment information, and contacts for doctors in lawyers, and store them in a safe and easy accessible location.

- Designate a trusted contact person. Add a trusted contact person to your brokerage account in case your broker has trouble contacting you or believes you are being scammed. The trusted contact person doesn't have access to the account holder's money.

- Social Security Advance Designation. The Social Security Advance Designation allows people to designate up to three people to serve as a "representative payee" should there be a need.

- Create a durable financial power of attorney. The durable power of attorney allows an agent, someone who has the legal authority to make financial decisions, with the power to make decisions if you become incapacitated. It can be changed or canceled if you still have decision-making capability.

- Ask for help. Involve a trusted friend, relative or professional in talks about your finances.

- Keep things updated. Be sure to keep accounts current and notify trusted contacts of any changes.

And if you suspect elder financial exploitation, call your local police department or sheriff to report it. If you suspect the financial abuse is stemming from brokers or investment advisers, here is who to call:

Source link