Parents are flooded with paperwork every single day of the year. But this year, they absolutely want to keep track of one key letter — Letter 6419, to be sent to you by none other than the Internal Revenue Service.

Do not throw this letter away. Keep it with all of your other important tax paperwork, including your W-2s.

Repeat, keep this letter to do your taxes.

The IRS said in early January that it started issuing these letters in December to those who received advance child tax credit money last year. But many parents had yet to spot this letter in the mail as of Jan. 19. It's important to keep an eye out for this information.

The IRS will kick off the tax season on Jan. 24 when it will first begin accepting and processing tax returns.

►2022 tax advice:How to get child tax credit cash, charitable deductions and free help

►When can you file? If the IRS is accepting tax returns Jan. 24, does that mean you'll get your refund early?

Some families may want to hold off a bit when it comes to filing a return until they spot the letter, which can help file them an accurate return and avoid delays. Others who don't want to wait may need to review their own records and check their specific information at the IRS "Child Tax Credit Update Portal Site."

Someone who normally does not make enough money to be required to file a tax return will still need to keep this letter to claim extra money that could be owed for the child tax credit when they file a 2021 federal income tax return.

"Even if you had $0 in income," the IRS notes, "you could have received advance Child Tax Credit payments if you were eligible."

►Save smarter, spend smarter:The Daily Money offers financial tips and advice. Sign up here.

When did the advanced child tax credit arrive?

Families who received the advance child tax credit in 2021— the money went out from July through December — must reconcile what they received last year with what their financial situation is this year, and file a Schedule 8812.

The monthly advance payments, part of a temporary expanded program, were designed so that half the total credit amount would be paid in advance monthly payments over those six months of 2021.

The tax filer will claim the other half when filing a 2021 income tax return. The IRS issued the first advance payment on July 15, 2021.

►Free filing:Want to file your tax return for free? TurboTax opts out of major program

►Budget shocks:Student loans, child tax credit unknowns could shock budgets in 2022

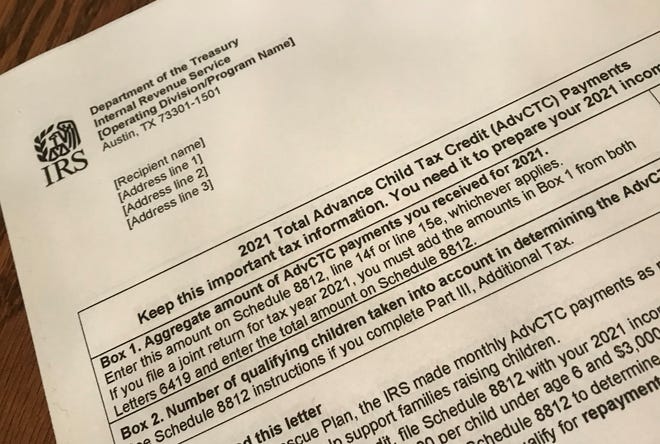

What does Letter 6419 look like?

While many have not yet seen the letter, I reviewed a sample copy that is posted online at IRS.gov. It was found on the IRS page called "Understanding Your Letter 6419."

Letter 6419 is a black-and-white one-page letter with an IRS logo on the top left corner. It is issued by the Department of Treasury and the Internal Revenue Service.

The letter has a big box at the top stating: "2021 Total Advance Child Tax Credit (AdvCTC) Payments."

The letter states in bold: "Keep this important tax information. You need it to prepare your 2021 income tax return."

The very top of the correspondence does not state "Letter 6419" in bold letters across the top. But it is marked as "Letter 6419" on the very bottom right-hand corner.

The term "Letter 6419" is also listed in Box 1 at the top of the letter in the sentence that refers to married couples filing a joint return for the tax year 2021.

Will I get one or two of these IRS letters?

Great question. You might expect one letter. After all, a married couple that files a joint return sends in one tax return, so it would be logical that one couple would receive one letter. But that's not the case at all.

The IRS will be sending two letters — and you're going to need to keep both of them — to married couples filing a joint return, according to April Walker, lead manager for tax practice and ethics with the American Institute of CPAs.

According to instructions on the example posted at IRS.gov: "If you file a joint return for tax year 2021, you must add the amounts in Box 1 from both Letters 6419 and enter the total amount on Schedule 8812."

Keep both letters. Do not assume you got a duplicate letter out of the blue and throw one away.

What key information is on IRS Letter 6419?

The letter itself spells out two key components that were used to calculate your advance child tax credit payments in 2021.

Box 1, which is at the very top of this letter, will tell you the total dollar amount of money you received for the advance child tax credit payments over six months in 2021. You need to enter that amount on Schedule 8812 called "Credits for Qualifying Children and Other Dependents" on line 14f or line 15e, whichever applies.

Box 2, which is right under Box 1, lists the number of qualifying children that were taken into account when the advance payments were determined for 2021. (Note: If you are dressing and feeding two little ones in the morning — including a baby born in 2021 — the box will likely list one child. Parents who had a baby born in 2021 did not receive advance payments last year but now can claim that child on their 2021 income tax returns to receive money.)

The IRS notes that "families who received advance payments need to file a 2021 tax return and compare the advance payments they received in 2021 with the amount of the child tax credit they can properly claim on their 2021 tax return."

Why does any of this matter?

If you lose the letter — and do not come up with a number that exactly matches the IRS files — you're likely to face lengthy delays in processing your income tax return.

And yes, you'll wait a long time to get your federal income tax refund.

Schedule 8812 notes specifically on Line 14f: "Caution: If the amount on this line doesn’t match the aggregate amounts reported to you (and your spouse if filing jointly) on your Letter(s) 6419, the processing of your return will be delayed."

Mark Steber, Jackson Hewitt’s chief tax information officer, cautioned tax filers that they need to make sure their total dollar amount for what was received for the advance payments is accurate when they file their tax returns.

"If this information isn’t correct on the 2021 tax return, taxpayers risk a delay in receiving their refund," Steber warned.

Antonio Brown, a CPA in Flint, Michigan, said on Jan. 20 that he had not heard of any of his clients getting the letter yet.

It is possible, he said, to file the tax return without the letter but you need to know exactly how much advance child tax credit you have received and how many dependents the money covered in 2021.

In general, Brown said, it is important to refer to Letter 6419 before you file a return because in some cases, a taxpayer could have received a different amount for one child under age 5 and another amount for the dependent ages 6 through 17. Some families could be confused about how much was received.

As part of the monthly payments, families received up to $300 for each child through age 5 or up to $250 each for children ages 6 through 17.

"The letter breaks down how much was received and how many dependents it was for," Brown said.

What is the IRS child tax credit update portal?

If taxpayers have not received the letter, taxpayers can look up the amounts on the IRS website at the "Child Tax Credit Update Portal." But you're going to need to create a user account with the IRS.

Brown noted that his early filer clients did not have the letter to prepare the return but they were able to go to the IRS website to obtain this information, or they reviewed their bank statements to find it.

George Smith, a CPA with Andrews Hooper Pavlik in Bloomfield Hills, Michigan, said he has one earlier filer client who fortunately did receive the letter already and they were able to easily file the return.

Can I get more money from the child tax credit?

Quite possibly. You want to file Schedule 8812 to claim any of your remaining money for the child tax credit.

"If you are eligible for the child tax credit, but did not receive advance child tax credit payments, you can claim the full credit amount when you file your 2021 tax return during the 2022 tax filing season," according to the IRS.

And again, you want to keep Letter 6419 to help you accurately report the total dollar amount you've already received upfront in 2021.

The total child tax credit for 2021 itself amounts to up to $3,600 per child ages 5 and younger and up to $3,000 for each qualifying child age 6 through 17.

If you have one child aged 3, you likely could have received $300 a month from July through December for a total of up to $1,800. Now, when you'd file your 2021 federal income tax return you could be owed another bit of money, up to $1,800.

The tax rules, though, are complicated and the actual amount you'd receive now for your child tax credit is based on your 2021 income. If your income went up substantially in 2021, you might not qualify for more credit cash.

Those monthly payouts in 2021 — via direct deposit into bank accounts or by paper check in the mail — were based on information from an income tax return you already filed or information you entered in the IRS non-filer sign-up tool in 2020 or 2021.

A lot might have changed in 2021, of course. Maybe you made more money last year and qualify for a smaller amount for the child tax credit than initially calculated.

The IRS suggests that you review each monthly payment, including any changes, at IRS.gov/ctcportal and then click “Manage Advance Payments.”

If you did not receive one or more payments for the advance child tax credit, you should contact the IRS at 800-908-4184 before filing your return.

Source link