Question: Do you have any advice for business owners looking to make investments and grow their businesses?

A: As CPAs and business owners ourselves, we understand the risks involved in operating an organization. However, success-oriented business leaders are always looking for opportunities in both prosperous and rocky times. They will often use “fear” as a competitive advantage.

In our experience as business advocates and advisers to many successful entrepreneurs, one common attribute they share is their “can-do” attitude. These leaders have the passion and persistence to make their dreams a reality, even when things seem bleak. They are optimistic about life, both in business and personally, and when they are faced with challenges, they develop plans to overcome the obstacles that may be standing in their way.

The most successful business leaders surround themselves with like-minded people. They do not operate in a vacuum. Instead, they look for best practices and engage others in the conversation. They work with key employees and advisers to develop strategies (short- and long-term) that will lead the business to the success they want to achieve. Then they create an action plan to achieve these goals, which should include metrics to measure progress and to hold people accountable.

It is critical that you, the business owner, believe in yourself and in your company. Others in your organization will follow your lead. Your enthusiasm and confidence will become contagious with everyone that comes into contact with your company, whether it is your employees, customers or vendors.

Now that we have discussed the importance of developing the right attitude for success, there are several other factors that will help you grow your business:

- Knowledge matters. Having the financial knowledge to understand and use your financial statements as a tool to manage your business is key. The old saying rings true: “Cash is king” –especially when it comes to the financial management of a growing company. While many people focus on the profit and loss statement in determining the health of a business, it is equally important to understand the balance sheet, which represents the assets, liabilities and net worth or your organization. You don’t need an MBA to analyze your data, but it is important to have a CPA, mentor, business partner or good financial adviser who can assist you in analyzing your organization’s financial health and develop strategies to make your company more profitable and stronger.

- Advisory groups. Formal or informal advisory groups such as a board of advisers or even a CEO roundtable can provide a place for you to tap into expertise you don’t yet have. Other business owners can offer strategies on marketing, managing vendors and even provide referrals.

- Business is business. Small businesses are very close-knit and at times can feel like family, which is why many business owners struggle with the human capital side of their organizations. If you have people issues, perhaps it is because certain of your employees don’t share your company’s core values. You may have individuals in the “wrong seat,” in that they are not able to fulfill the most important roles in their job function. You simply can’t keep people around if they are destroying your company culture by not exhibiting the organization’s core values, or if they are not capable of fulfilling their role in the business. Maintain a strong work ethic and don’t compromise on core values. Stay true to your purpose.

- Hire creatively. If you are considering an expansion but don’t want to add full-time staff because of economic uncertainly, consider using independent contractors or temporary employees instead of hiring permanent employees.

- Embrace technology. Leveraging technology can be crucial for success-oriented small-business owners. Find ways to become more effective and efficient by utilizing technology. Valuing innovation and using it to your advantage can help you get ahead of your competition.

- Look for best practices. Be open to learning how other owners run their business and how these strategies could improve your company. You can also learn from mistakes made by others.

- Forward thinking. Be aware of trends in your industry and any adjustments you may need to make to remain or become more competitive. Planning for both the short- and long-term are critical. Futuristic thinking will not only set you apart, but also puts you in a much better position to consider your business decisions and options in advance.

Be proactive and take the initiative to grow your business. Look at the current state of our economy as an opportunity to move forward. Things don’t always go as planned and will change as time goes on. However, as a small business, you have the flexibility to adjust quicker to those changes.

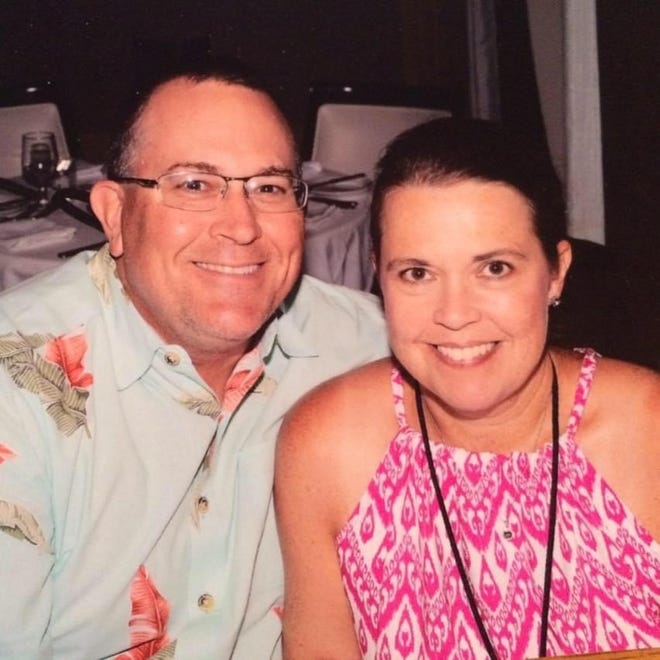

Crystal Faulkner is a Cincinnati market leader with MCM CPAs & Advisors, a CPA and advisory firm offering expert guidance and beyond the bottom line thinking for today’s public and private businesses large and small, not-for-profits, governmental entities and individuals. Tom Cooney is with Wealth Dimensions, an investment advisory firm. For additional information, call 513-768-6796 or visit online at mcmcpa.com. You can listen to Tom and Crystal daily on WMKV and WLHS on “BusinessWise,” a morning and afternoon radio show that profiles highly successful people, companies, organizations and issues throughout our region.

Source link