Jo Marie Hernandez doesn’t know how she and her four-year-old daughter will survive after her unemployment aid lapsed this weekend.

Hernandez, who lives in Olean, New York, is on the brink of losing her home in days after she lost her job as a customer service associate at a gas station in the spring. Following prolonged unemployment, she's struggled to make ends meet and has nothing left in savings to keep her afloat.

“I only have $100 left to my name. My whole world is shattered,” says Hernandez, 32, who has been forced to put her car up for sale. “We can’t wait a few weeks for help. We’re starving and will be out on the street soon.”

Relief in doubt as shutdown looms

President Donald Trump delayed signing the $900 billion COVID-19 relief bill this weekend and demanded that lawmakers more than triple the size of stimulus checks, leaving 14 million unemployed Americans like Hernandez without an economic lifeline for rent and food. That has particularly hit minority workers hard, who face further household financial distress, eviction and hunger as stimulus aid dries up following months of deadlock in Congress.

“Politicians keep giving us false hope, but they are out of touch with the American people,” says Hernandez. “It’s not easy being poor. No one sees us.”

Democrats and Republicans each blamed the other for their inability to come to an agreement until this month. While unemployment benefits have remained a point of contention, House Speaker Nancy Pelosi railed against Republicans and the Trump administration for their demands that companies be shielded from coronavirus-related lawsuits. Senate Majority Leader Mitch McConnell opposed Democratic requests that state and local governments be given more funds to offset their budgets after the pandemic. Neither liability protections nor state and local aid ended up in the final bill.

The stalled measure also raises concern about other critical aid for small businesses and an eviction moratorium that is set to expire at the end of the month.

The fate of the stimulus package is uncertain – along with the $1.4 trillion spending bill attached to the relief measure that would keep the government open past Monday – which Trump signaled he may veto if stimulus payments aren't increased to $2,000 from $600.

Now congressional leaders are scrambling to avoid a government shutdown Tuesday. The House plans to vote Monday on whether to substitute the $2,000 checks in the bill.

But that is too little, too late for millions on unemployment, experts warn. The economic repercussions will be dire for struggling Americans as layoffs remain historically high and the pandemic forces further business closures following a spike in COVID-19 cases.

Stimulus checks:Here’s who doesn't get the $600 stimulus check if COVID-19 relief bill signed

“Without those unemployment checks, people won’t take their insulin. There will be foreclosures and evictions. People will sell their car. People won’t eat. The human toll can’t be overstated,” says Michele Evermore, senior researcher and policy analyst for the National Employment Law Project.

So far, the nation has recovered 56% of the 22.2 million jobs wiped out in the health crisis. The total number of COVID-19 cases worldwide has topped 80 million, while the death toll in the U.S. has surpassed 330,000, according to Johns Hopkins University.

Small businesses on the brink

The bill would also replenish the Payroll Protection Program, a rescue plan that provided loans for struggling small businesses to keep their workers on the payroll.

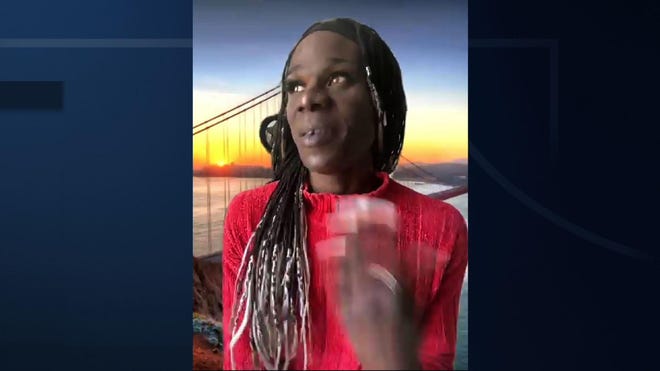

Renard Beaty, owner of Kick Start Martial Arts in Atlanta, Georgia, was a small business owner who received a loan in the spring, which helped sustain his business after he was forced to lay off employees.

But he fears he’ll have to cut his staff again without additional relief for his mixed martial arts studio.

“It’s a scary time. If I have to close my doors because I can’t pay my rent, it will lead to bankruptcy, which means I may lose my house,” says Beaty, 58. "This is all I have. No one will hire me at my age. Washington is playing politics in the worst way with people’s lives.”

Millions face poverty without more aid

Nearly 5 million people, including 1.3 million children, will fall into poverty in January if Congress fails to extend temporary pandemic unemployment programs that expired Saturday, according to a recent study by Columbia University.

An extension of those unemployment benefits and a weekly $300 federal supplement would keep 7.6 million Americans out of poverty in January, including 2.3 million children, Columbia University researchers found.

The delay in the measure becoming law threatens to create financial ruin for struggling Americans who will lose their last economic lifeline, according to Andrew Stettner, senior fellow at The Century Foundation, a think tank.

“How do people end up in long-term poverty? They typically lose their job and their unemployment benefits run out before they can find another one,” says Stettner. “It’s a spiral that they can’t get out of that leads to mental health problems.”

COVID-19 relief package:$600 stimulus checks, $300 bonus for federal unemployment benefits in new deal

“That’s what we’re trying to prevent," adds Stettner. "We don’t need to make this pandemic so much worse than it already is by not dealing with the economic consequences.”

Disparity in jobless rates grow

The loss of unemployment payments hits minorities, especially Black workers, the hardest. They typically have higher rates of unemployment and longer durations of joblessness, according to Evermore.

The duration of unemployment has historically been significantly longer for Black and Asian workers than for whites. Unemployment for Black and Asian workers typically lasted an average of about 26 weeks before the pandemic, compared with 20 weeks for white and Latino workers, Evermore said.

The pandemic has widened the historic income inequality for Black, Latino and Asian workers, experts say, following a growing divide between the haves and have-nots. Wall Street, for instance, has roared back to record heights after the fastest crash in history in the spring, but much of the economy continues to struggle and many Americans who don’t own stocks or retirement accounts have missed out.

“For months, people have been living below the poverty level. They don’t have any savings,” Evermore said. "This falls on workers of color, especially Black workers, and their communities."

Which unemployment aid will end?

In March, the CARES Act created two programs to help keep jobless workers afloat after the pandemic battered the global economy and led to a historic wave of unemployment. The two programs ended Saturday.

The first was the Pandemic Unemployment Assistance (PUA) program, which provides aid to self-employed, temporary workers and gig workers. It had included a $600 weekly supplement for jobless workers through late July.

The second program was the Pandemic Emergency Unemployment Compensation (PEUC) program, which provides an additional 13 weeks of benefits beyond the typical 26 weeks states provide to jobless workers. Many out-of-work Americans had already used up their state unemployment aid, which typically expires after six months, and had transitioned to PEUC.

About 9.2 million workers saw their PUA benefits expire Saturday, and roughly 4.8 million workers lost their PEUC benefits, according to Stettner.

Now that the aid has lapsed, those on PUA such as gig workers aren’t eligible for regular unemployment programs and will lose their benefits. Just under 4 million PEUC recipients could transition to extended benefits, which vary by state and last an additional 13 to 20 weeks. But states will have to pick up half of the cost at a time when their trust funds are depleted Stettner adds.

That means 10.5 million workers in total will have lost CARES Act benefits by year’s end.

Workers lose a week of benefits

Even if the measure becomes law next week, there will be a temporary lapse in unemployment benefits until the first week of January, according to Evermore. Because the aid lapsed Saturday, the $300-a-week jobless supplement will now last for 10 weeks instead of the 11 weeks originally in the package, unless Congress amends the bill, she added.

Once an extension of the programs is signed into law, states will have to wait for the Labor Department to issue guidance before sending out payments.

The week ended Dec. 26 is the last one that benefits can be paid since unemployment is paid out weekly, according to experts, unless the legislation becomes law.

Even if Trump signs the legislation next week, it will take at least two to three weeks on average for most state unemployment agencies to reprogram their computers, Evermore estimates.

"State agencies are freaking out," says Evermore. "In theory, Congress could make this retroactive, but it will take states weeks before they get things up and running. Not only will people not get a check for next week, but the following few weeks will be delayed as well."

Source link