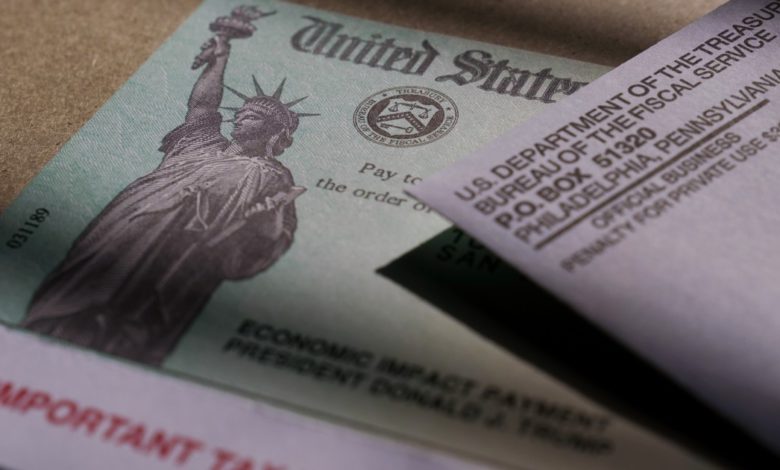

As many Americans who do not file taxes and are on federal programs such as Social Security have not received a stimulus check, the IRS said Tuesday checks will be disbursed to them this week.

The IRS added that most will receive their payment by April 7.

“If no additional issues arise, the IRS currently expects to complete that work and to begin processing these payment files at the end of this week,” the IRS said in a statement Tuesday. “Because the majority of these payments will be disbursed electronically – through direct deposits and payments to existing Direct Express cards – they would be received on the official payment date of April 7.”

Additionally, the IRS stated that the “Get My Payment” tool will not be updated until April 3 or 4.

Tuesday’s announcement affects those who receive Social Security, Supplemental Security Income (SSI), and Railroad Retirement Board (RRB) beneficiaries who did not file a 2019 or 2020 tax return or did not use the Non-Filers tool. The IRS did not have details for those who are VA beneficiaries, adding that payments “could” be processed by mid-April.

As of last week, 127 million Americans had received a stimulus check, largely going to those who file taxes. Democrats on the House Ways and Means Committee Chairman demanded that the Social Security Administration transfer to the IRS the information needed to administer the payments to federal beneficiaries.

On Thursday, Social Security Commissioner Andrew Saul explained that there were some bureaucratic hang-ups that caused the payments to take longer than for those who file a tax return with the IRS.

The Social Security Administration said it has been working with the IRS to arrange a “reimbursable agreement” in order to administer payments to those on Social Security. Saul said that the Social Security Administration completed sending the IRS files of recipients last Thursday.

“(Social Security) SSA’s public service mission is squarely focused on many of those who are most economically-vulnerable in our society and we owe it to our beneficiaries to ensure they receive their (Economic Impact Payments) EIPs right away,” Saul said. “In fact, it was the substantial efforts of SSA that successfully overcame the fact that the IRS did not have a mechanism to automatically identify Supplemental Security Income (SSI) recipients, some of the most financially insecure people in America. It was SSA that pushed the prior Administration and Congress to allow us to send to IRS a file of those individuals, who do not receive forms SSA-1099, so that IRS could automatically issue EIPs to them.”

Most Americans making up to $75,000 a year are getting a direct payment of $1,400 (couples making up to $150,000 a year will get $2,800). Heads of households making up to $112,500 annually also will receive the full $1,400.

Those making $75,000 to $80,000 ($150,000 to $160,000 for couples) will get a prorated check. Those making over $80,000 ($160,000 for couples) will not receive a check.

The IRS is using “adjusted gross income” to determine income eligibility for payments. If you have not filed a 2020 tax return, the IRS will use 2019 tax information to determine eligibility.

Contact Justin Boggs on Twitter @jjboggs or on Facebook.